As WA businesses enter a new calendar year, don’t forget the incentives and subsidies that could help keep your business strong in 2021.

JobKeeper 2.0

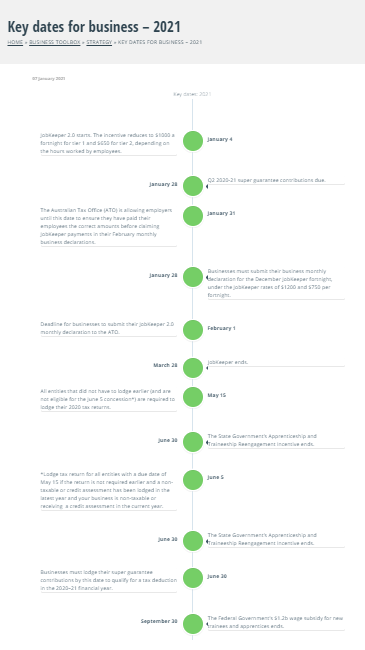

Employers wishing to continue to utilise the JobKeeper scheme during its second extension from January 4 to March 28 must take steps to maximise their entitlements.

JobKeeper reduces to $1000 a fortnight for tier 1 and $650 for tier 2, depending on the hours worked by employees.

To continue to receive JobKeeper payments for your staff, you must prove your eligibility by re-assessing whether your GST turnover has declined by the required amount (generally 30 per cent) in the December 2020 quarter compared with a similar period in the previous financial year (usually December 2019).

Decline in turnover forms are available from the Australian Tax Office (ATO) from January 4 and must be completed before you submit your JobKeeper 2.0 business monthly declaration on February 1.

Employers that meet the wage conditions for JobKeeper 2.0 are required to notify their workers which payment rate applies to them, within seven days of notifying the ATO of these rates.

By January 28, businesses must submit their business monthly declaration for the December JobKeeper fortnights, under the JobKeeper rates of $1200 and $750 per fortnight for tier 1 and 2 respectively.

The ATO is allowing employers until January 31 to ensure they have paid their employees the correct amounts before claiming JobKeeper payments in their February monthly business declarations.

Businesses who have existing JobKeeper directions in place but do not meet the qualifications for JobKeeper 2.0 may continue to receive some JobKeeper provisions as a legacy employer.

To continue to access JobKeeper provisions a legacy employer, businesses must demonstrate at least a 10 per cent decline in GST turnover in 2020, when compared to the same quarter in 2019.

For more information about JobKeeper 2.0 and legacy employer tips visit CCIWA’s COVID-19 website and for more about JobKeeper deadlines visit the ATO.

Apprenticeship funding

The Federal and State Governments announced some key incentives for employers to take on apprentices and trainees during 2020-21.

The Federal Government’s $1.2 billion measure for new apprentices and trainees offers a 50 per cent wage subsidy up to $7,000 a quarter to employers who take on apprentices from October 5 2020 to September 30 2021.

The program is capped at 100,000 places, which are expected to be exhausted in the first quarter of this year.

The State Government recently announced it would not charge payroll tax on wage subsidies for these new apprentices and trainees, equating to about $4 million in tax relief.

The WA Government’s Employer Incentive Scheme is still available for businesses, with a payment of up to $8,500 available to employers who take on new apprentices up to $4,250 for those who hire new trainees.

This scheme was introduced on July 1 2019.

WA’s Apprenticeship and Traineeship Reengagement Incentive encourages businesses to employ apprentices or trainees who have lost their job as a result of COVID-19.

The incentive provides businesses a one-off payment of $6000 and $3000 for re-engaging an apprentice or trainee respectively and applies to workers who commenced between July 1 2020 and June 30 2021.

Tax incentives

Businesses with an aggregated turnover of $5b or less can get an immediate tax deduction for the full cost of eligible assets purchased from October 6 2020 and ready for use by June 30 2022.

The instant asset write-off extension also allows for a full write off of second-hand assets for businesses with a turnover of less than $50m as well as for the cost of any improvements businesses make to existing assets.

From April 1 2021, the ATO is set to introduce new fringe tax benefits exemptions for businesses.

Click here for our key 2021 dates timeline in Business Toolbox.