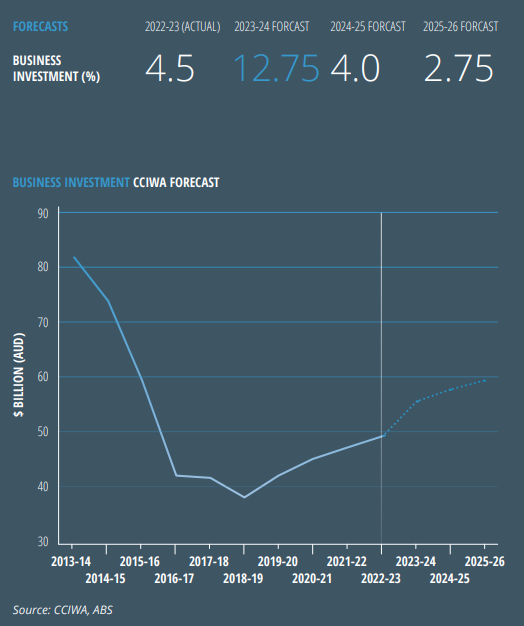

Western Australian investment surged in 2023 and the year ahead is also showing signs of strong growth, with the resources sector continuing to be the primary driver.

CCIWA’s latest Outlook report predicts business investment to grow by 12.75% in 2023-24, up from 4.5% the previous year where it reached almost $50 billion – a six-year high.

2022-23 investment movements

Emerging sectors also gained traction as investment increased in agriculture, advanced manufacturing and space – sectors that were identified as key investment opportunities in the Government’s Diversify WA framework.

Growth in government investment was also the strongest of all states, increasing by 10.8% in 2023, according to the Australian Bureau of Statistics.

This was underpinned by the State Government’s record investment in infrastructure, including METRONET, major road projects and new energy infrastructure to help decarbonise the State’s economy.

Infrastructure drove government major project investment in road, rail and energy, primarily supported by $294 million allocated from the State Budget.

Decarbonisation efforts also prompted significant investments in renewable energy projects, such as the main electricity grid and Synergy’s big batteries.

Business investment outlook

“We expect to see strong growth in imports, driven by an uptick in business investment in WA, and that is expected to detract from the overall growth number,” says CCIWA Chief Economist Aaron Morey.

“We’re also seeing some of WA’s major iron ore projects operating at close to capacity, and a drop in agricultural exports driven by El Nino weather events after a bumper year in 2022-23.

“So, while the outlook is predicting a drop in growth for the overall economy, we expect WA to continue to punch above its weight in the context of global conditions.

“And while overall growth is expected to slow, domestic-driven growth or state final demand is set to remain strong.”

Iron ore demand has helped to offset the collapse in nickel and lithium prices which have plunged in the past 12 months.

“Continued strong business investment and a solid pipeline of major projects are encouraging signs for the longer-term strength of WA’s economy,” Morey says.

“However, we believe ongoing cost pressures, industrial relations reforms and regulatory reforms that delay approval timelines pose an ongoing threat to this growth.”

For the latest economic reports see CCIWA’s Economic Insight page.

If you are looking for support or advice in business, investment or trade, contact our experienced International Trade and Investment Centre team at [email protected].